APP

Safe and stable trading system

Safe and stable trading system

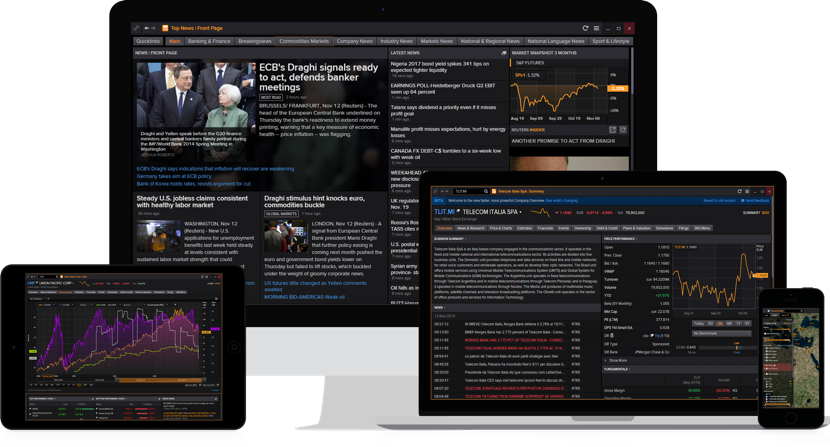

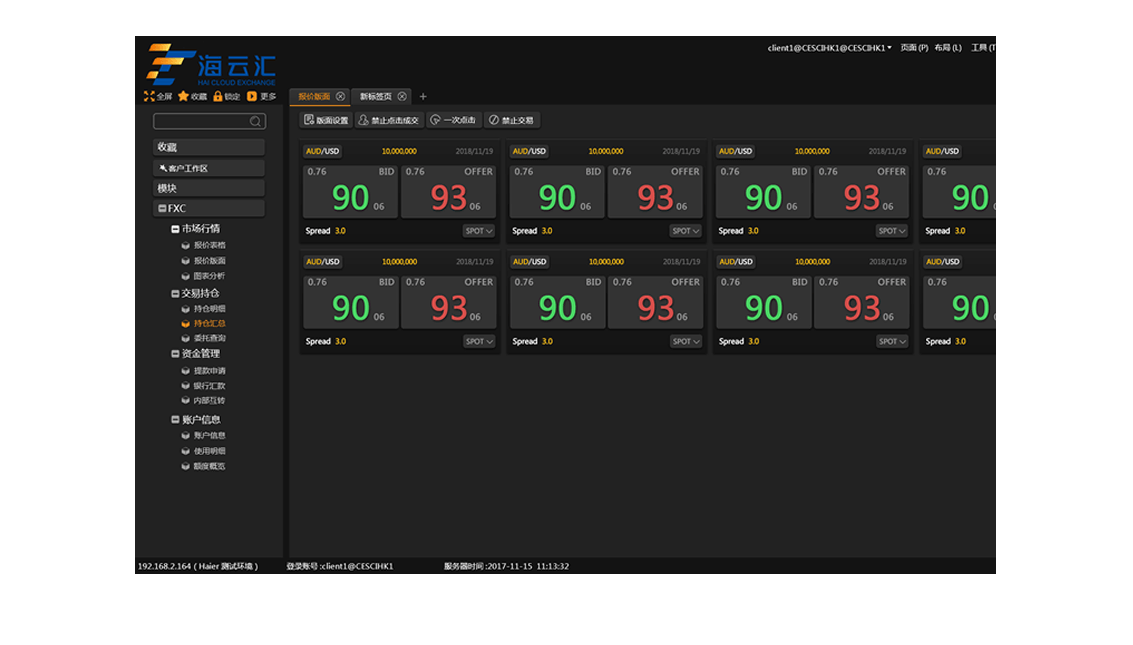

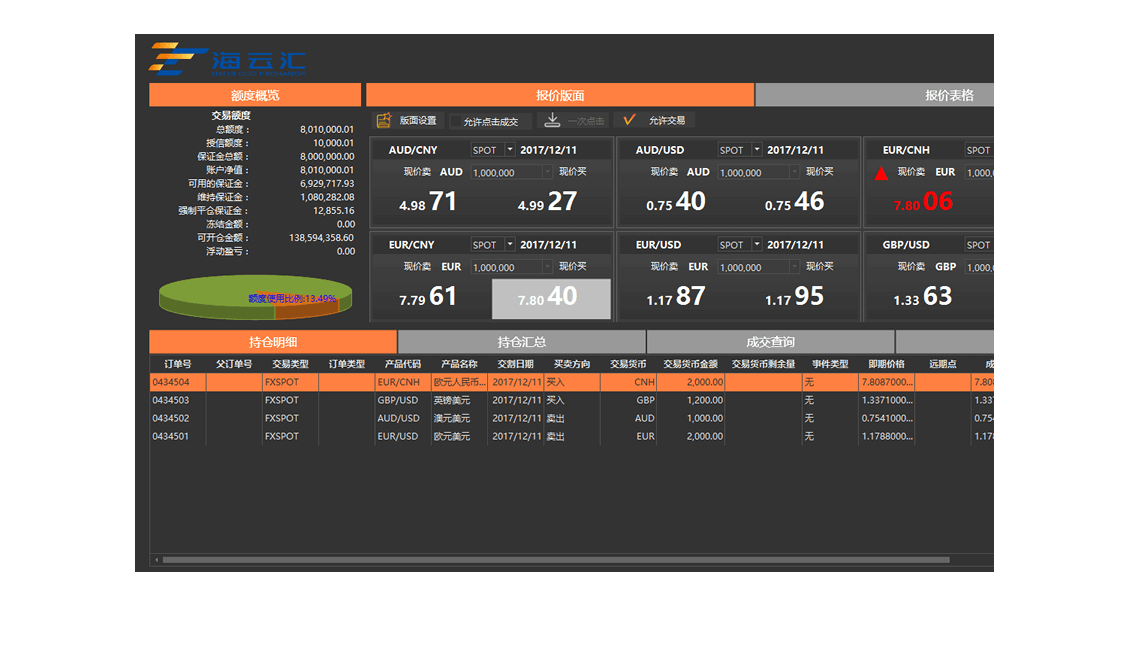

Thomson Reuters provides Hai Cloud Exchange with seamless foreign exchange trading system solutions, including Thomson Reuters’ global real-time market data source (ERT), the enterprise data platform (TREP), Thomson Reuter FXall and FX Trading, among them. Hai Cloud Exchange has been using Thomson Reuters FXall to achieve 24-hour fluidity of foreign exchange quotation . The strategic cooperation between the two sides is supposed to help Hai Cloud Exchange, through Thomson Reuters’ leading foreign exchange trading service, improve its timeliness, security and compliance of its foreign exchange trading and risk management system, so that Hai Cloud Exchange can offer a more user-friendly foreign exchange trading service with rapid transactions and convenient delivery to small and medium-sized enterprises and individual clients.

The internationalization of RMB and the thriving financial science and technology are bringing an increasingly far-reaching impact and challenge to financial institutions and enterprises. A foreign exchange platform with stable data, transparent process, controllable risk and 24-hour fluidity of foreign exchange quotation is an important cornerstone for enterprises to orderly carry out financial business.

Thomson Reuters’ solutions to foreign exchange trading system will provide Hai Cloud Exchange with fair data in the global foreign exchange market. Thomson Reuters’ real-time data service can be released to Hai Cloud Exchange’s local system through interfaces and thus guarantees the stability and timeliness of data. In addition, the strategic cooperation between the two sides will help Hai Cloud Exchange optimize its risk management process and compliance review process, ensuring the compliance of its transactions and helping Hai Cloud Exchange reach the balance between cross-border innovations and risk control at the same of simplifying trading process.

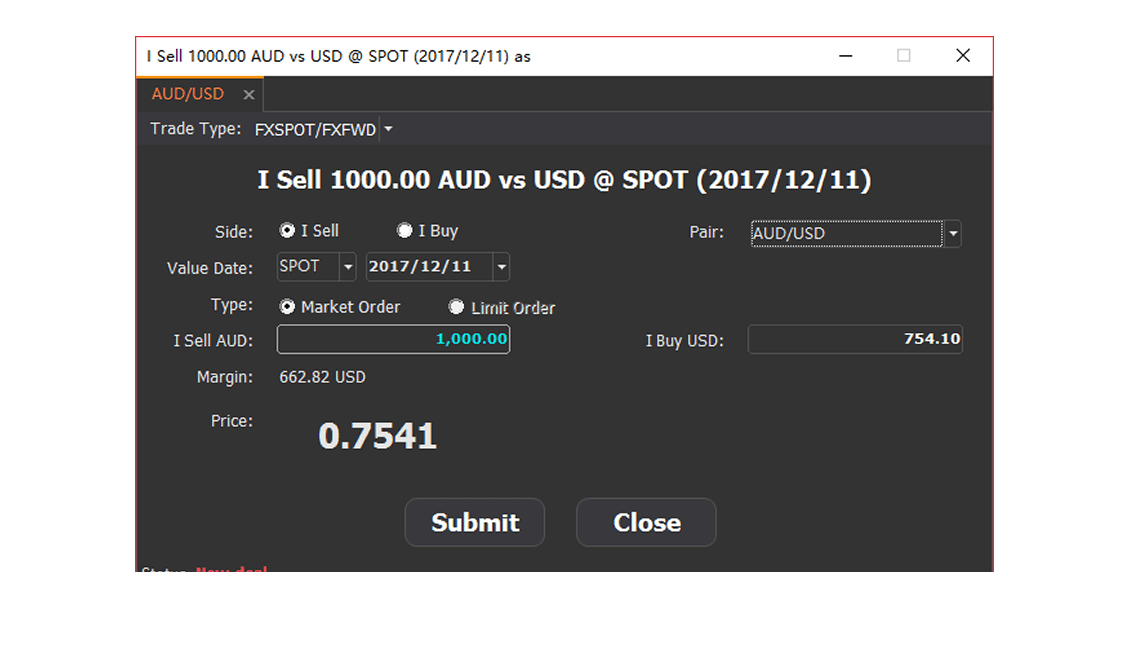

Thomson Reuters FXall global electronic foreign exchange trading platform is composed of a wide range of flexible execution tools, end-to-end workflow management, straight-through trading tools. Users can follow up the price of different counterparties at the same time, automatically pick out the best price and make a deal efficiently.