About US

Connect the world, create wealth.

HCE: one-stop cross-border financial services platform

Hai Cloud Exchange (collectively include Hai Cloud Exchange (HK) Limited and HCE International Service Limited) were incorporated in Hong Kong since August 2016 and its strategic positioning is to become China’s first one-stop cross-border financial services platform. As a financial services institution with unique “corporate perspective” characteristics under Chinese-funded industrial capital, Hai Cloud Exchange focuses on providing supply chain financing, currency exchange, cross-border payment, , exchange rate and interest rate risk management solutions for SMEs and individual customers. One-stop cross-border financial services, empowering their trading advantages and risk management advantages to a wide range of industrial users,The service areas cover cross-border e-commerce, aviation, grain and oil, and tourism.

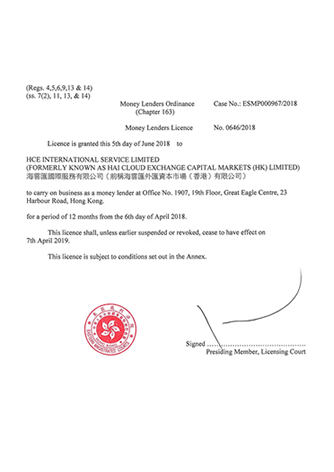

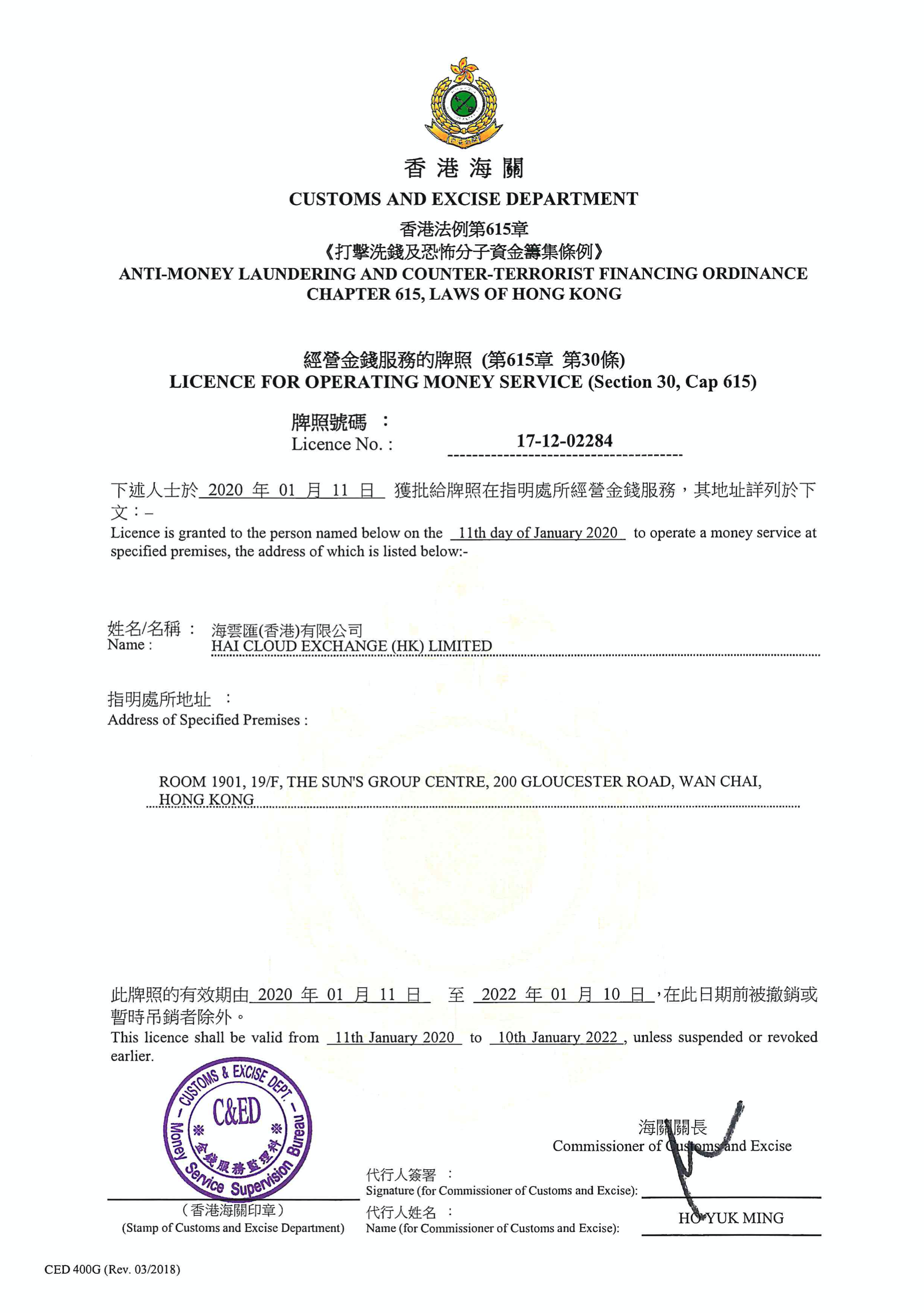

Located in Hong Kong, the company aims to make full use of Hong Kong’s unique advantages as an international financial center to provide customers with richer financial products, more convenient user experience, more flexible trading mode and efficient professional services. Hai Cloud Exchange (HK) Limited has obtained the Dealing in Securities licence (Regulated Activity Type 1) and Leveraged Foreign Exchange Trading licence (Regulated Activity Type 3) granted by the Securities and Futures Commission (SFC), and the Hong Kong Money Service Operator’s licence, which are subject to the supervision of Hong Kong Regulatory Authorities. And HCE International Service Limited has obtained the Hong Kong Money Lender’s licence;HAI Smart Alpha has obtained Asset Management licence (SFC regulated activity type 9).

Platform Advantages – Serving 4,000 global suppliers, 30,000 distributors, and many years of industry finance experience.

Focus on the Industry – From the industry, better understand the needs of industrial finance, and possess the unique financial risk management and product development capabilities of the industry investment bank.

Diversified Services – Providing one-stop financial services in cross-border scenarios, overseas accounts, currency exchange, cross-border payment, exchange rate risk management, foreign currency financial management, foreign currency financing.